Most ebook files are in PDF format, so you can easily read them using various software such as Foxit Reader or directly on the Google Chrome browser.

Some ebook files are released by publishers in other formats such as .awz, .mobi, .epub, .fb2, etc. You may need to install specific software to read these formats on mobile/PC, such as Calibre.

Please read the tutorial at this link: https://ebookbell.com/faq

We offer FREE conversion to the popular formats you request; however, this may take some time. Therefore, right after payment, please email us, and we will try to provide the service as quickly as possible.

For some exceptional file formats or broken links (if any), please refrain from opening any disputes. Instead, email us first, and we will try to assist within a maximum of 6 hours.

EbookBell Team

4.0

36 reviews

ISBN 10: 1292158336

ISBN 13: 978-1292158334

Author: Jonathan Berk

For MBA/graduate students taking a course in corporate finance.

An Emphasis on Core Financial Principles to Elevate Individuals’ Financial Decision Making

Berk and DeMarzo’s Corporate Finance uses a unifying valuation framework, the Law Of One Price, to present the core content instructors expect, the new ideas they want, and the pedagogy their students need to succeed.

Corporate Finance: The Core fits programs and individual professors who desire a streamlined book that is specifically tailored to the topics covered in the first one-semester course. For programs and professors who would like to use a text in a two semester, or more, sequence, please see Corporate Finance, the 31-chapter book also by Jonathan Berk and Peter DeMarzo.

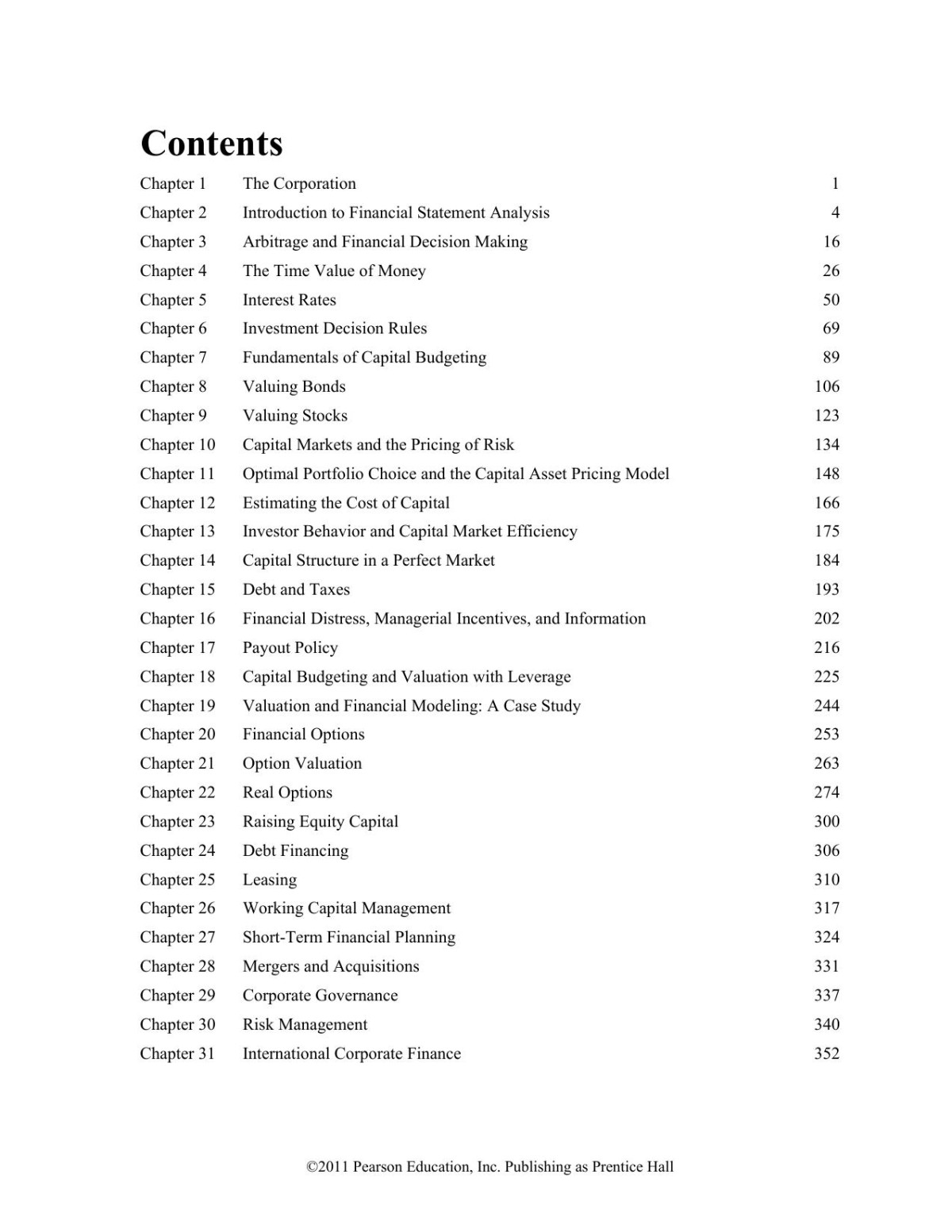

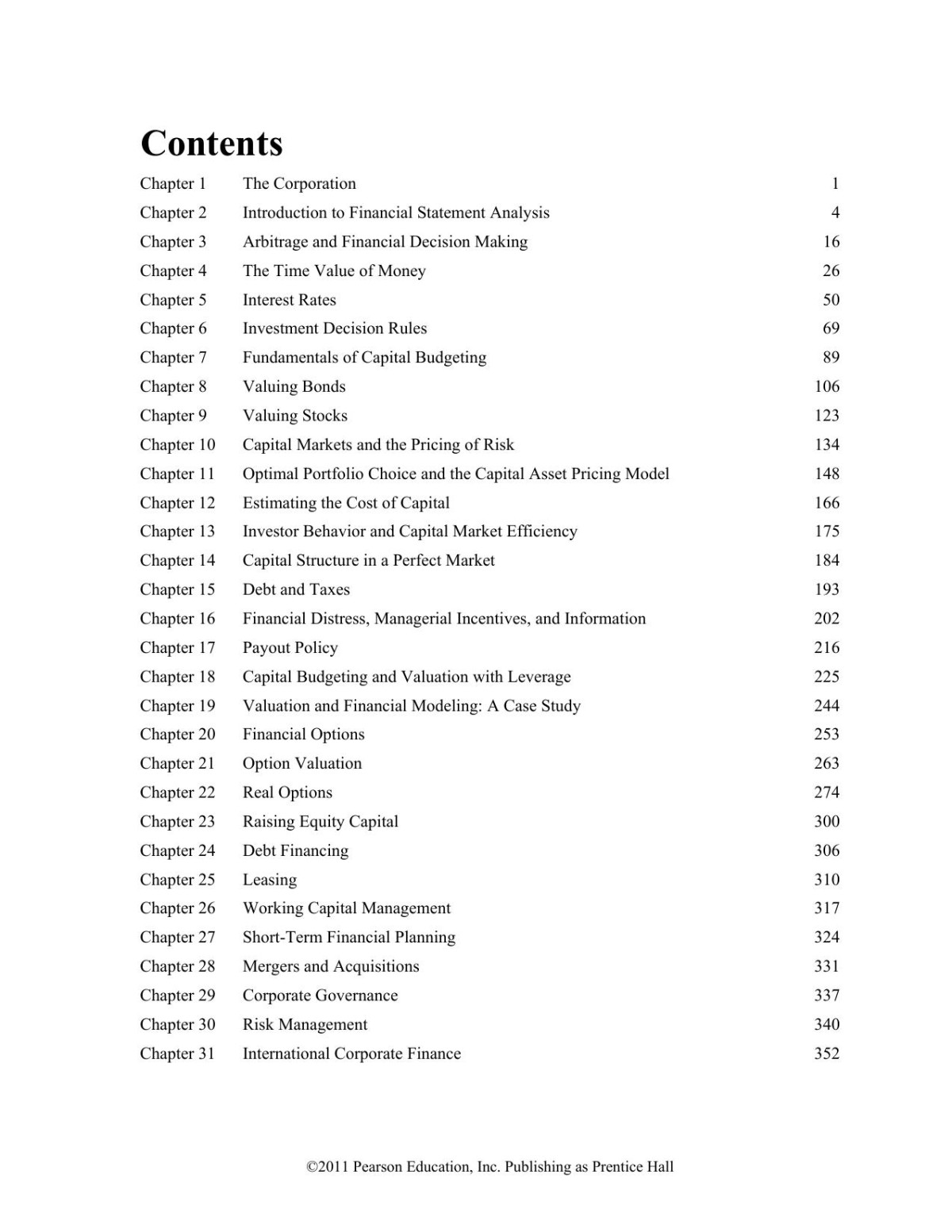

Chapter 1: The Corporation and Financial Markets

Chapter 2: Introduction to Financial Statement Analysis

Chapter 3: Financial Decision Making and the Law of One Price

Chapter 4: The Time Value of Money

Chapter 5: Interest Rates

Chapter 6: Valuing Bonds

Chapter 7: Investment Decision Rules

Chapter 8: Fundamentals of Capital Budgeting

Chapter 9: Valuing Stocks

Chapter 10: Capital Markets and the Pricing of Risk

Chapter 11: Optimal Portfolio Choice and the Capital Asset Pricing Model

Chapter 12: Estimating the Cost of Capital

Chapter 13: Investor Behavior and Capital Market Efficiency

Chapter 14: Capital Structure in a Perfect Market

Chapter 15: Debt and Taxes

Chapter 16: Financial Distress, Managerial Incentives, and Information

Chapter 17: Payout Policy

Chapter 18: Capital Budgeting and Valuation with Leverage

Chapter 19: Valuation and Financial Modeling: A Case Study

Chapter 20: Financial Options

Chapter 21: Option Valuation

Chapter 22: Real Options

Chapter 23: Raising Equity Capital

Chapter 24: Debt Financing

Chapter 25: Leasing

Chapter 26: Working Capital Management

Chapter 27: Short-Term Financial Planning

Chapter 28: Mergers and Acquisitions

Chapter 29: Corporate Governance

Chapter 30: Risk Management

Chapter 31: International Corporate Finance

corporate finance the core 5th edition by berk and demarzo

fundamentals of corporate finance and corporate finance the core

corporate finance the core 5th edition

corporate finance the core global edition

corporate finance the core by berk and demarzo

corporate finance the core 4th edition

Tags: Jonathan Berk, Corporate Finance, Core