Most ebook files are in PDF format, so you can easily read them using various software such as Foxit Reader or directly on the Google Chrome browser.

Some ebook files are released by publishers in other formats such as .awz, .mobi, .epub, .fb2, etc. You may need to install specific software to read these formats on mobile/PC, such as Calibre.

Please read the tutorial at this link: https://ebookbell.com/faq

We offer FREE conversion to the popular formats you request; however, this may take some time. Therefore, right after payment, please email us, and we will try to provide the service as quickly as possible.

For some exceptional file formats or broken links (if any), please refrain from opening any disputes. Instead, email us first, and we will try to assist within a maximum of 6 hours.

EbookBell Team

4.1

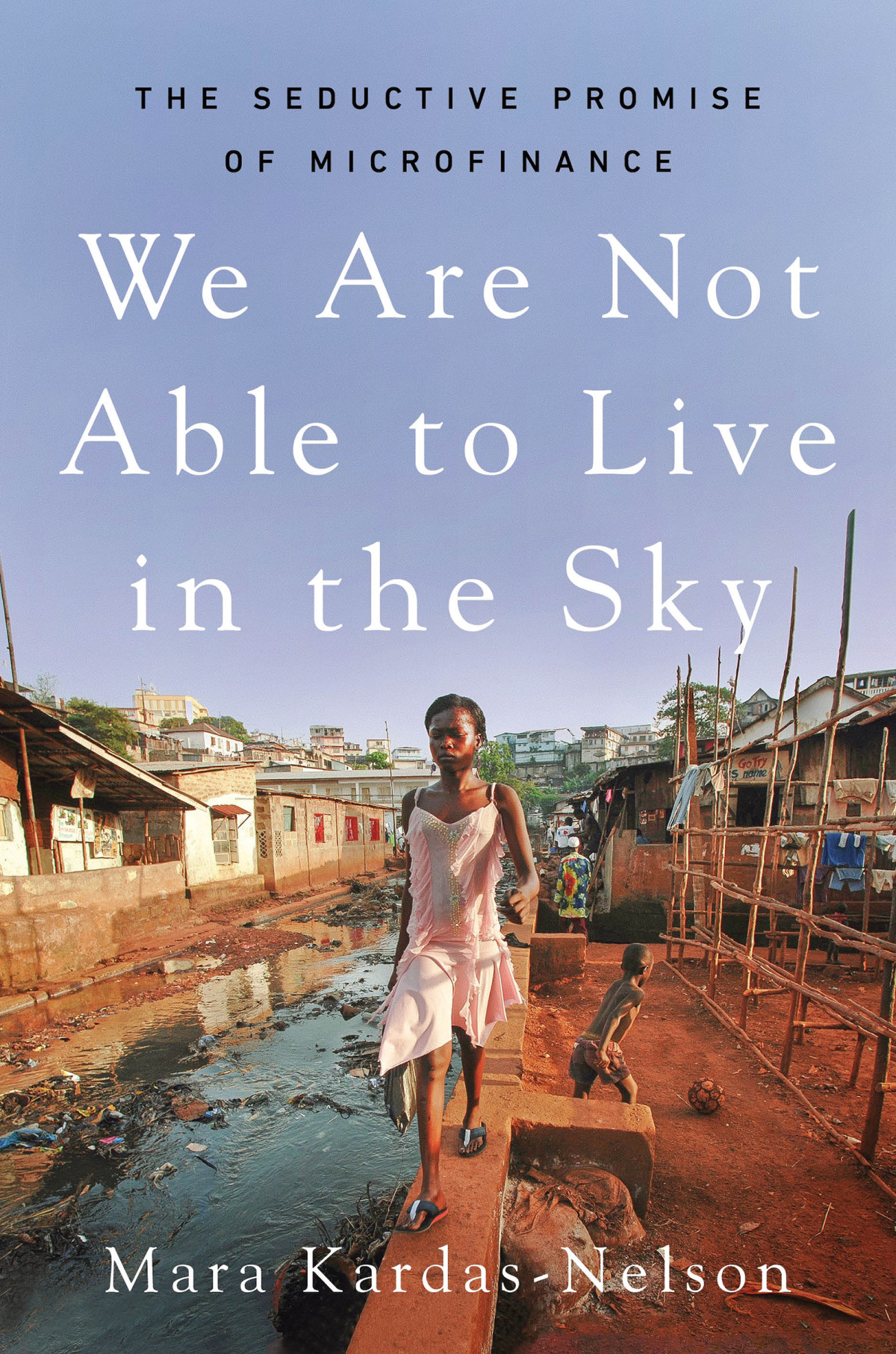

50 reviewsA deeply reported work of journalism that explores the promises and perils of microfinance, told through the eyes of international lenders and women borrowers in West Africa

In the mid-1970s, Muhammad Yunus, an American trained Bangladeshi economist, met a poor female stool maker who needed money to expand her business. In an act widely known as the beginning of microfinance, Yunus lent $27 to forty-two women, hoping small credit would help the women pull themselves out of poverty. Soon, Yunus's Grameen Bank was born, and the idea of giving very small, high-interest loans to poor people took off. In 2006, Yunus and the Grameen Bank won the Nobel Peace Prize for "efforts to create economic and social development from below."

But there's a problem with this story. There are mounting concerns that these small loans are as likely to bury poor people in debt as they are to pull them from poverty, with borrowers from India to Kenya facing consequences such as jail time...